Life insurance is a contract between the person who buys the policy and the company that issues the policy. The insurance company gives you life insurance and, in some cases, investment options, and you agree to pay a fixed premium to keep your policy going. The death benefit payout is what your nominee gets if something happens to you during the policy term. People buy life insurance plans, so their families have money and security when they need it most.

Why Should You Buy Life Insurance?

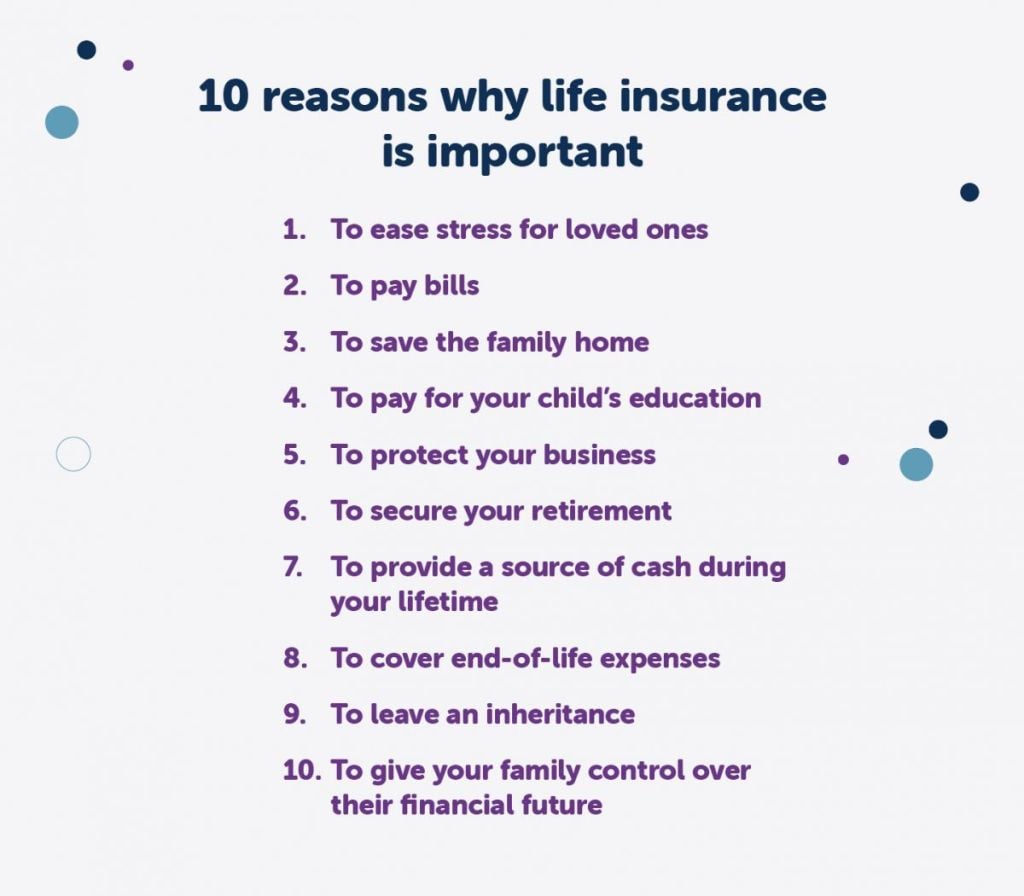

There are many benefits of life insurance. But the harsh truth is that none of us knows what our lives may bring. If something terrible happens, it could hurt our family. Even though no one can take your place, the money from a life insurance policy can help your family start over. Here are a few reasons why it’s crucial to have life insurance:

- Financial Safety Net

You work to make money so your family can live a certain way. If something unfortunate happens to you, your family might be unable to pay the bills or meet their other financial needs. Without your money and help, they may have to change how they live and how they do things. If you have life insurance, your family can get financial help in the event that something happens to you. When they need it the most, the money gives them some financial stability.

- Products and riders that fit your needs

There are different plans for your different needs, such as whole life insurance, term insurance, ULIPs, annuity plans, and so on. You can also add riders or extras to your insurance plan to protect yourself. Ultimately, you can buy a life insurance policy that best fits your wants and needs.

- Can help you build wealth

The money you pay as a premium is used to buy different market instruments on your behalf. You get the corpus as a maturity benefit when the policy ends. You can use this money to pay for your retirement and have a good time.

- Acts As A Loan-aid

Some insurance companies may let you borrow a specific amount based on your policy’s cash value. Basically, if you want to borrow money from a bank, you can use your life insurance plan as collateral and get a secured loan. Most of the time, the interest rates on these loans are lower.

- Tax Benefits

You can enjoy a tax deduction on your premiums to keep your policy in force. Taxes differ based on the old and new tax regimes.

What Life Insurance Should You Buy and When:

Life Insurance Plans should be bought as soon as possible. You may pose a lesser risk to the insurance company when you are younger. So, for a better sum insured, they may offer lower premiums. As you get older, there’s a greater chance of you undergoing health issues which could increase your premiums. The sooner you buy your policy, the more time you may get to grow your money and build up.

What kind of life insurance policy you should get depends on your lifestyle, your goals, and your budget. A life insurance premium calculator can help give you an estimate of the amount you need to pay as the premium.

- Endowment Plan

These policies cover your life for a certain amount of time. As the plan’s maturity benefit, the insured person gets a lump sum payment when the plan ends. Endowment plans give you protection and a chance to make your money grow.

- Term Plan

A term policy doesn’t offer any payout on ending. These policies offer insurance, covering your life for a certain time. If the insured person lives past the policy’s term, they won’t receive any money from it. Term plans are great for younger people who want premiums that aren’t too expensive. Before your term policy ends, you can change it into a whole life policy for your peace of mind.

- Unit-Linked Insurance Plan

Unit-Linked Insurance Plans (ULIPs) let you invest your money in different market funds and simultaneously offer you life insurance. You have visibility over your investment, and the insurance company uses a portion of it as a premium to cover your life. ULIPs are ideal when you’re saving up for long-term goals.

Once you know your choices, you can choose the best plan for your needs. When choosing a sum insured, you should think about inflation and any debts you have. A life insurance plan gives your family a safety net in case something happens to you. If something bad happens to you, they can use the money from your life insurance policy to pay off your debts and replace the income you would have earned.