Contents

Introduction

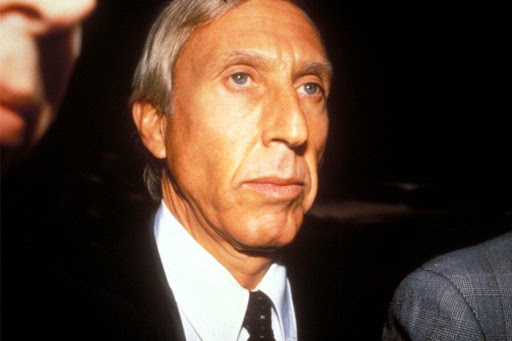

Ivan Boesky was an American banker and a specialist in corporate takeovers. In the 1980s, he became notorious for his role in an insider trading scandal that involved the Enron corporation. In 1987, a court found Boesky guilty of fraudulent securities transactions and insider trading, and he was sentenced to three years in jail for his crimes. Boesky gained his notoriety through his involvement in the Ivan Boesky insider trading scandal, which was one of the most high-profile financial crimes of its time.

Insider Trading by Ivan Boesky

Ivan Boesky was an American trader and investor who made a lot of money on Wall Street by using information he shouldn’t have had. He was known for being smart about business, and at Drexel Burnham Lambert, he was the second-largest shareholder. Back in November 1985, Boesky started making money by trading on private information. He heard this from lawyers, accountants, and bankers who worked for the same company. Boesky used the stock market tips he got to buy and sell stocks before the rest of the public knew about them. This made it possible for Boesky to make a lot of money from these deals.

The SEC’s Investigation as a Case Study

In November 1986, the SEC began to look into claims that Boesky had traded on inside information. During their investigation, the SEC found proof that Boesky had traded stocks illegally based on information he got from insiders. Some of this information was stock tips that Boesky had gotten from people who worked inside companies. The Securities and Exchange Commission also found that Boesky lied to them and did illegal things to the market to make more money.

How the SEC’s investigation turned out and how it changed things

The SEC’s investigation into Boesky’s wrongdoing had a big effect on the stock market. When investors saw what Boesky had done, they lost faith in the market and Wall Street. Also, it made the SEC investigate insider trading by people who work for the company more closely.

Ivan Boesky’s Time in Prison

Ivan Boesky was a trader on Wall Street who became well-known after he was caught in a big scandal involving insider trading. In December 1986, after pleading guilty to one count of conspiracy to commit securities fraud, he was given a prison sentence of three years.

Boesky made a lot of money on the stock market by trading based on information he got from insiders. He was one of the most powerful traders on Wall Street in the 1980s, with an estimated net worth of around $200 million. But in November 1986, he was accused of breaking the Securities Exchange Act by trading on inside information without permission.

The case against Boesky was part of a federal probe called the Insider Trading Scandal that looked into insider trading on Wall Street. As part of his deal to plead guilty, he agreed to help the government investigate. He also agreed to pay fines and restitution totaling $100 million.

In December 1986, a judge gave Boesky a three-year prison sentence and a $100 million fine. He spent 18 months in Otisville, New York, at the Federal Correctional Institution. He read a lot and wrote his book “Ivan Boesky: Confessions of a Wall Street Raider” while he was in prison.

The Ivan Boesky prison sentence was seen as a strong signal from the government that it was serious about cracking down on insider trading. The scandal also showed how dangerous it can be to make investment decisions based on too much inside information. It set the stage for future changes in the securities industry and made people more aware of how important ethical behavior is.

The Ivan Boesky scandal was one of the most important turning points in Wall Street’s history. It showed how dangerous insider trading can be and led to several changes in the securities industry. It also showed how important ethical behavior is in financial markets and sent a clear message that the government was serious about stopping fraud.

The Ivan Boesky prison sentence was seen as a severe penalty for his crimes and a warning to others who may consider engaging in similar activities. He paid a steep price for his illegal activities, but the lessons learned from his case are still relevant today. To this day, the Ivan Boesky prison sentence serves as a reminder of the consequences of engaging in illegal insider trading and other fraudulent activities.

Effect on the Financial System

Boesky’s conviction and sentence had a major effect on the market. There was a clear message made that insider trading would not be allowed by the lengthy prison sentence and hefty punishment. Several Wall Street traders heard this message and became warier in their trading. The SEC responded by cracking down on company insiders and regulating the financial markets more strictly.

Ivan Boesky’s Legacy

The effects of Ivan Boesky’s criminal behavior on the global financial system were widespread. As a result of his conduct, the SEC instituted new rules and began to closely monitor business executives. It also prompted new regulations and altered how Wall Street professionals viewed the practice of insider trading.

Revisions to SEC Rules

In response to Boesky’s illegal actions, the SEC revised its rules in several important ways. The Insider Trading Sanctions Act of 1988 and the Insider Trading and Securities Fraud Enforcement Act of 1988 are two examples of the legislation that brought about these alterations. These statutes toughened punishments for insider trading and simplified SEC investigations and prosecutions of offenders.

Budgetary Adjustments

Due to Boesky’s illegal actions, the SEC also made changes to the financial system. New rules were implemented to improve market transparency and safeguard investors from scams as part of these changes. The SEC also implemented new rules to restrict corporate leverage and improve transparency for investors.

Conclusion

The illicit insider trading actions in which Ivan Boesky engaged had a major influence on the global financial markets. As a result of his conduct, the SEC instituted new rules and began to closely monitor business executives. It also prompted new regulations and altered how Wall Street dealt with insider trading. Because of these reforms, investors are safer against fraudulent operations, and the markets are more open and transparent.